Chamber Launches Informative Guide on Business Taxes

Understanding the Tax Landscape

Chamber Launches Informative Guide on Business Taxes

The Revelstoke Chamber of Commerce is proud to introduce a comprehensive guide aimed at helping local businesses navigate the complexities of taxes. This new document, “What Are Business Taxes?”, provides essential information on the municipal, provincial, and federal tax structures, offering insights into how taxes are assessed, collected, and used to support the community.

Understanding the Tax Landscape

The guide covers everything from property tax calculations and annual tax cycles to the impacts of various tax classes, such as Residential, Business/Other (Commercial), Recreation/Non-Profit, and Industry. It highlights the disproportionate tax burden shouldered by businesses in Revelstoke and discusses how this affects operations, growth, and competitiveness.

Key Features of the Guide:

- A breakdown of tax classes and their multipliers.

- Visuals showing tax contributions across different classes.

- Step-by-step explanations of how and when taxes are collected.

- A detailed look at the impacts of taxes on businesses, residents, and industries.

- Frequently asked questions to address common concerns.

A Call to Action

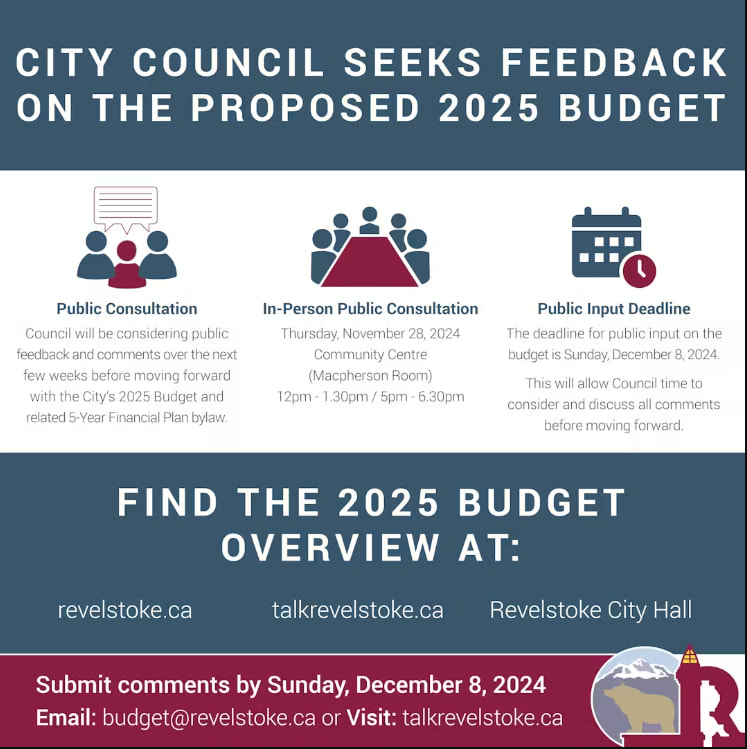

As the City of Revelstoke seeks feedback through its 2025 Budget Survey, the Chamber encourages local businesses to engage in the conversation about tax fairness and sustainability. This guide is a step toward fostering informed dialogue and ensuring that the voices of Revelstoke’s business community are heard.

Download the Guide Today

Click here to access “What Are Business Taxes?” and learn more about how taxes impact your business and the community. Together, we can work toward a balanced and equitable tax framework for Revelstoke.